michigan gas tax increase history

Map shows gas tax increases in effect as of March 1 2021. 10 states to have gone two decades or more without a gas tax increase.

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Michigans diesel fuel tax was adopted in 1947 at a rate of five cents per gallon.

. The Michigan House voted 63-39 mostly along party lines to approve House Bill 5570 which would suspend the 272-cent state gas and diesel fuel prices for six months from April 1 to Sept. And Michigan with a gas-tax diversion rate of 339 is ranked with New Jersey as the third highest GTDR in the nation. The gas tax currently sits at 19 cents per gallon while diesel is 15 cents per gallon.

Since 2013 33 states and the district of columbia have enacted legislation to increase gas taxes. Is A Michigan Gas Tax Increase Inevitable. In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247.

Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a. Whitmer proposed a 45-cent gas tax increase to help fix Michigans crumbling roads. The increase is capped at 5 even if actual inflation is higher.

1927 2 to 3 001 05 1466 015 1951 45 to 6 002 0333 101 015 1972 7 to 9 002 0286 624 012 1979 9 to 11 002 0222 376 008 1984 1261 to 1455 002 0154 252 005 1997 1455 to 18715 004 0286 161 007 2017 18715 to 259055 007 0384 106 008 august 2019 inflated cpi. The current federal motor fuel tax rates are. Michigan enacted its first ever sales tax through Public Act 167 in 1933.

If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. Michigan drivers have already absorbed an increase 73 percent that big since Gov. Michigan Gas Tax 95 0190 Michigan Sales Tax 51 0102 School Aid 730 0075 Rev.

When gas is 389 per gallon that. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. Thirteen states have gone two decades or more without a gas tax increase.

Gasoline 272 per gallon. The michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states. Sharing 240 0025 Comp.

It will have a 53 increase due. 30 0003 General Fund 00 0000 What Makes Up the Price of a Gallon of Gas Assuming gasoline costs 200 per gallon Figure 2 of a gallon of gasoline is 200 per gallon the Michigan sales tax comprises 102 cents of that price. The 3 sales tax was on retail sales of tangible goods.

Alternative Fuel which includes LPG 263 per gallon. Starting January 1 2017 gas taxes will increase 73 cents and diesel will. Nineteen states have waited a decade or more since last increasing their gas tax rates.

The 25 billion plan would increase the 26-cent fuel tax by 45 cents between this October and October 2020 and guarantee that the additional revenue is targeted to. Gas Tax rate can vary from 283-363 cpg depending on area Other Taxes include 2071 USTInspection fee diesel 125 cpg state sales tax 2196 USTInspection fee gasoline The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. Gasoline Tax established at 2 cents per gallon.

Diesel Fuel 263 per gallon. 1 Among the findings of this analysis. The current state gas tax is 263 cents per gallon.

Raise the 19-cents-gallon gasoline tax and 15-cent diesel tax. Gasoline 263 per gallon. But you also pay the Michigan 6 percent sales tax.

Federal Motor Fuel Taxes. Diesel Fuel 272 per gallon. Federal excise tax rates on various motor fuel products are as follows.

Two years later in 1927 the rate was increased to three cents per gallon. Inflation factor value of increase. The tax on regular fuel increased 73 cents per gallon and the tax on diesel fuel increased 113 cents per.

Hawaii Illinois Indiana and Michigan apply their general sales taxes to gasoline and thus see ongoing changes in their overall gas tax rates based on changes. The nine-bill package to spend more on the states deteriorating road infrastructure will. This week Gov.

36 states have raised or reformed gas taxes since 2010. The chart accompanying this brief shows as of July 1 2017 the number of years that have elapsed since each states gas tax was last increased. This may well bring the annual increase close to.

In 1960 voters approved an increase of the 3 sales tax to 4. Gretchen Whitmer made her controversial gas tax proposal earlier this month. For fuel purchased January 1 2022 and after.

Michigan Gas Tax 95 0190 Michigan Sales Tax 51 0102 School Aid 730 0075 Rev. Michigan first enacted a fuel tax in 1925 at a rate of two cents per gallon. 0183 per gallon.

Michigan first enacted a fuel tax in 1925 at a rate of two cents per gallon. 15 rows Historic Motor Fuel Tax Revenues. For fuel purchased January 1 2017 and through December 31 2021.

Most states tax motor fuels with a per unit tax such as the 263 cents per gallon levied by michigan. Most jet fuel that is used in commercial transportation is 044gallon. Liquefied Natural Gas LNG 0243 per gallon.

1 2017 as a result of the 2015 legislation. Michigan fuel taxes last increased on Jan. The steadily rising price of fuel up.

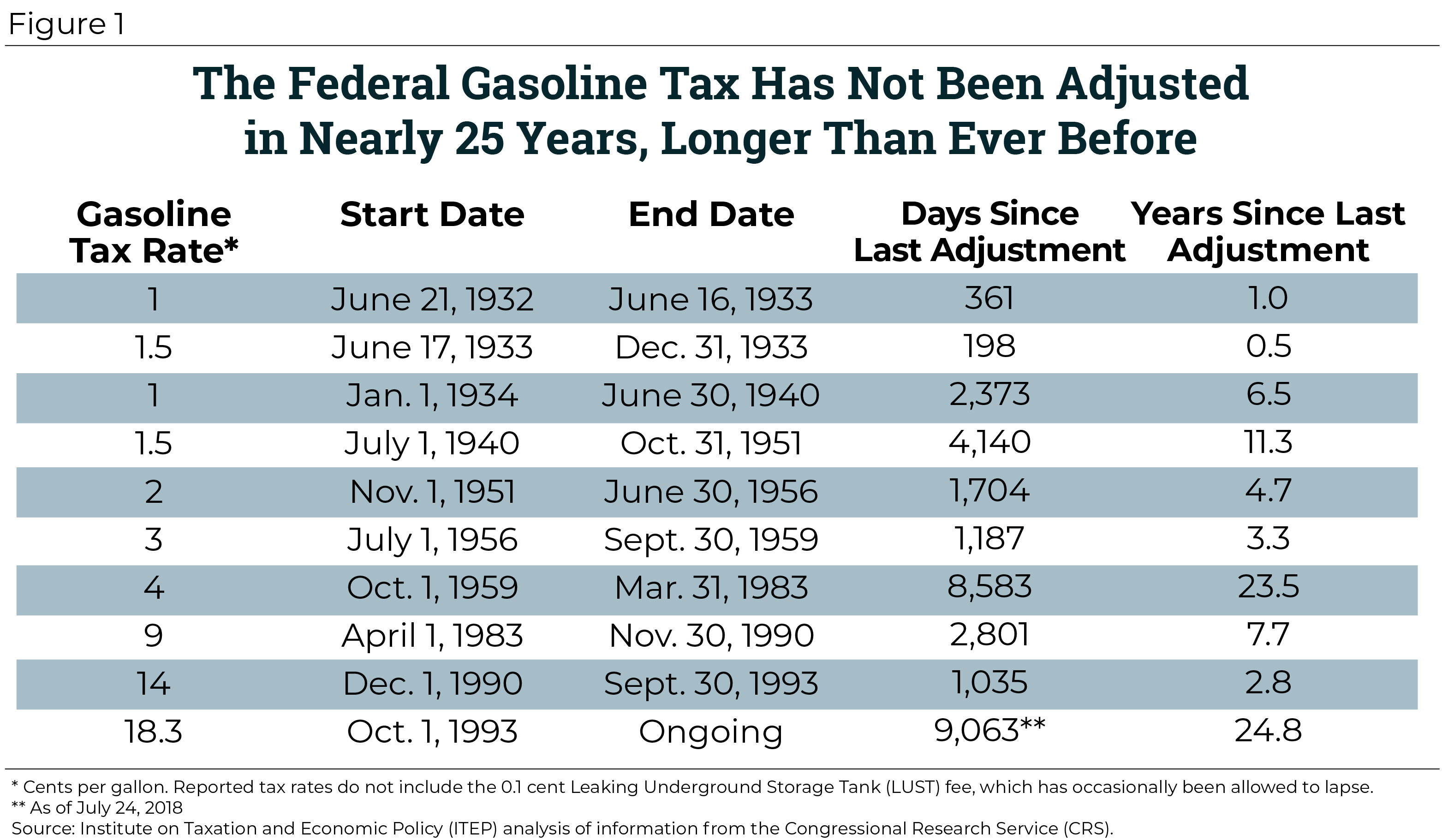

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

U S State And Local Motor Fuel Tax Revenue 2019 Statista

U S State And Local Motor Fuel Tax Revenue 2019 Statista

Most States Have Raised Gas Taxes In Recent Years Itep

War On Cars Visclosky Consultant Says Hidden Metric Is What 5b Transformation Plan Is Really About How To Plan Sayings War

Motor Fuel Taxes Urban Institute

General Electric Company Stock Certificate 1941 Stock Certificates Dow Jones Index Electric Company

Tax Base Definition What Is A Tax Base Taxedu

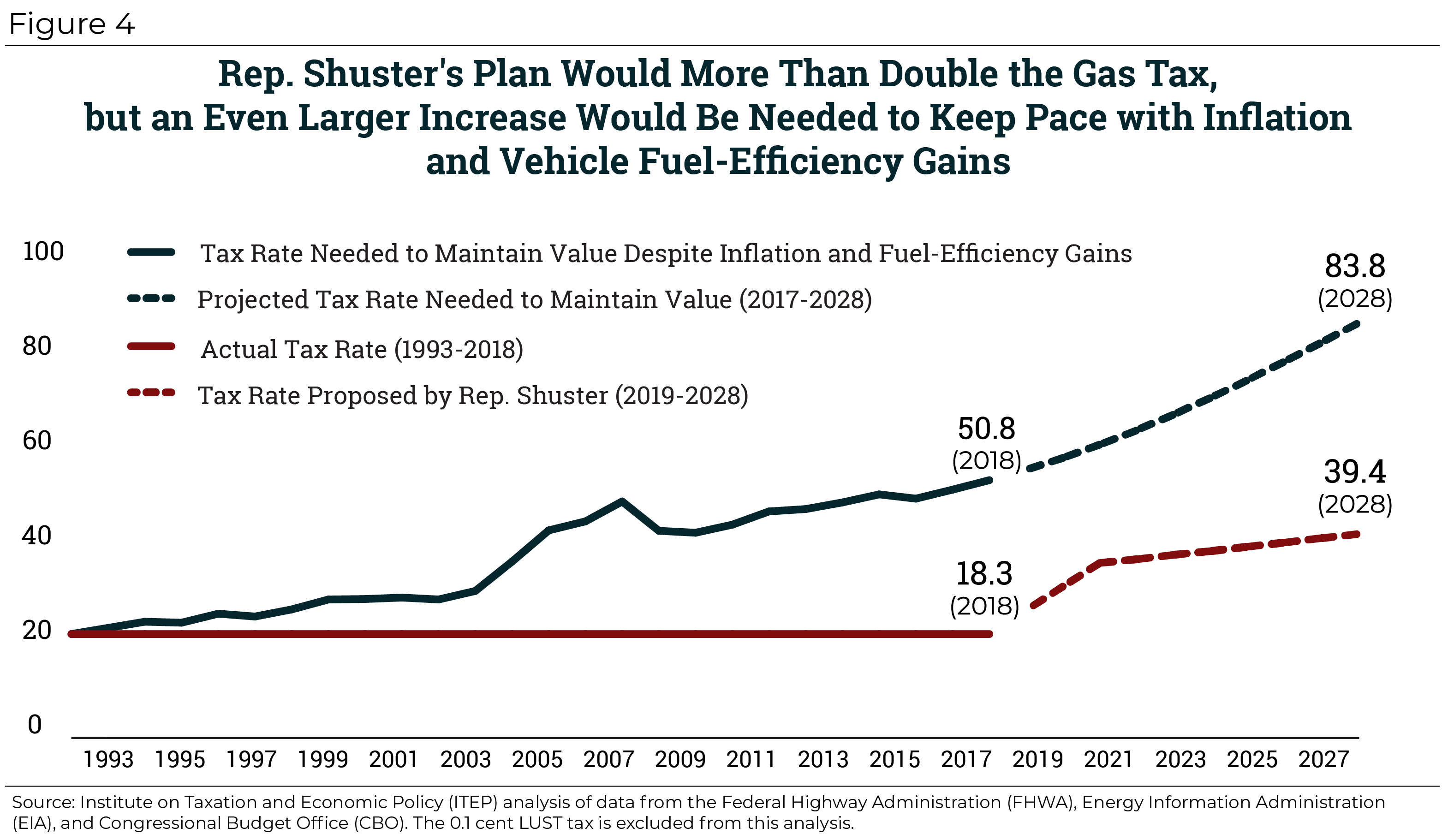

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

The World Urgently Needs To Expand Its Use Of Carbon Prices The Economist

Exterior Pictures From Hgtv Urban Oasis 2016 Craftsman House Bungalow Exterior Craftsman Bungalows

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep

It S Been 10 000 Days Since The Federal Government Raised The Gas Tax Itep

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy